Two-Pot Temptation

Withdrawing from your Two-Pot system now, especially after festive overspending, will compromise your future retirement plans.

29 January 2026

6.2 min read

After an expensive December holiday season – when many people are facing credit-card bills, festive spending hangovers, and Two-Pot withdrawal offers – it’s tempting to take cash out of your retirement savings to ease the short-term squeeze. But acting on that impulse comes with a steep price: any early withdrawal from your Two-Pot Savings Pot is taxed at your full marginal income tax rate and permanently reduces the amount invested for your retirement, meaning you miss out on decades of compound growth that could have made that money worth many times more by the time you retire.

Under the Two-Pot rules, your retirement savings are split into separate components: a Savings Pot (accessible once per tax year) and a Retirement Pot (preserved for retirement income). Any withdrawal from the Savings Pot is added to your taxable income for that year and taxed at your full marginal income tax rate, the same rate that applies to your salary, with no preferential tax table for early access.

Many people who accessed their seed capital of R30 000 in 2024 are now tempted to withdraw additional money from their Two-Pot Savings Pot. But each withdrawal still has real costs – both in tax today and in lost future growth tomorrow.

REMEMBER: You Still Pay Full Marginal Tax on Every Withdrawal

There’s no special lower tax table for these pre-retirement withdrawals. That more favourable tax treatment only applies to lump-sum withdrawals at actual retirement, where the first R550 000 is tax-free under the retirement tax table.

Every amount you take from your Savings Pot, whether the initial R30 000 or additional amounts like R12 000,is treated as ordinary income in that tax year and taxed at your marginal income tax rate. That’s the same rate that applies to your salary, which can range from 18% up to 45% depending on your income level.

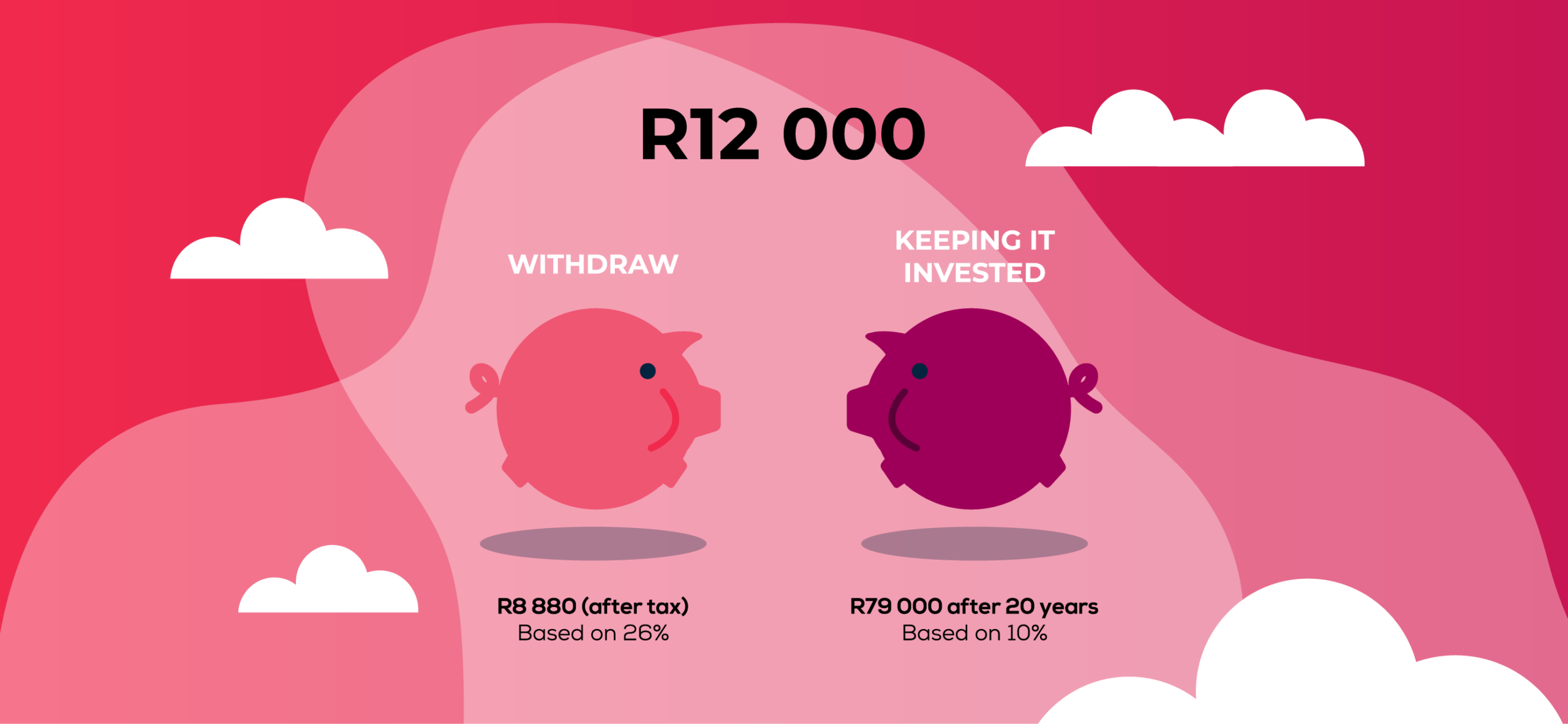

An example of how a Two–Pot withdrawal of R12 000 today is taxed and how it reduces your possible future retirement value:

- Firstly, you will pay tax.

Suppose your taxable income (salary and this withdrawal) puts you in the 26% marginal tax bracket.

Tax on R12 000 = R3 120 (26% × R12 000)

That leaves you with a net payout of R8 880 (and some pension fund administrators charge a fee to process your Two-Pot claims)

Yes, this money is yours today, but a chunk has already gone to taxes, which you can never get back.

- Secondly, what could it be worth in 20 years if you didn’t take the cash today, i.e., the opportunity cost?

Imagine leaving that R12 000 in your retirement fund. At 10% annual average return – a reasonable long-term assumption for a diversified retirement portfolio – the future value after 20 years would be R79 000.

That’s because growth compounds over time, earning interest on interest.

In our example:

- Withdraw today → receive R8 880 (after tax).

- Leave it invested → could become R79 000 by retirement (based on 20 years and a return of 10%).

In other words, by withdrawing R12 000 now, you’re potentially giving up R70 000 of future retirement value (for a short-term cash need).

There could be alternative options…

If you need cash in an emergency, consider alternatives that may be less costly than withdrawing from your Two-Pot Savings, which is taxed at your marginal rate.

For example, short-term lending from a bank or other credit provider might have lower interest costs than the tax you would effectively pay on a Two-Pot withdrawal, depending on your individual tax bracket and the terms of the lending.

Consult your financial adviser to weigh all options before acting.

Even if you previously took your R30,000…listen up.

If you’ve already accessed your seed value of R30 000 before, withdrawing more from your Savings Pot won’treset or reduce the tax cost; it still counts as income and reduces your capital.

And because the Savings Pot stops earning investment returns once you take money out, this money is gone permanently lost from your retirement nest egg; you can’t replace it under the same tax-advantaged structures.

Decision Checklist – Before you complete that Two-Pot Withdrawal Form

- Every Two-Pot withdrawal is taxed as income at your marginal rate today.

- That tax bite immediately reduces what actually goes into your pocket.

- Withdrawing now will reduce your future retirement value by missing compound growth.

- Retirement savings are uniquely powerful because of tax-deductible savings, and compound interest –money left invested has not yet been taxed, and it grows much more than the original amount.

- Am I sure that this is the only option available to me?

If you’ve already taken your seed amount in 2024/2025 and are thinking about accessing more, ask yourself:

- Is this cash need truly more important than an extra R70000 – R100 000 in my retirement fund?

- Could I find alternative ways to meet short-term needs without jeopardising my long-term financial security?

Early access might feel good now, but the math shows it can seriously weaken your retirement future, especially when the taxman and compound interest can work so powerfully against you.

Speak to your retirement fund consultant or financial adviser before making a decision you might regret later,and most importantly, try to create your own emergency savings so that you do not need to dip into your retirement fund.

This article is intended for general information purposes only and does not constitute financial, tax, legal, or investment advice. The information provided is based on general principles and may not be appropriate for your individual circumstances. You should consult a qualified financial adviser or other professional before making any financial decisions.

Get an email whenever we publish a new thought piece